Starting to understand trading can feel intimidating. It's important to remember: every experienced trader was once a beginner. Initially, the terms might sound like confusing technical jargon, but once you grasp the basics, you'll see that it's a logical system where the key is to take the first step. Let’s break down 12 key terms that will help you feel more confident on this journey.

1. Asset

An asset is what you trade. It can be stocks, currencies, oil, or cryptocurrency. Think of it as an item that can change in value. Knowing what you're working with is the first step to understanding.

2. Exchange

Imagine an exchange as a giant virtual market: traders worldwide buy and sell assets. Exchanges come in different types: stock (e.g., NYSE), cryptocurrency (e.g., Binance), and commodity (e.g., trading oil, gold). Don’t fear them—they’re tools for success.

3. Liquidity

Liquidity refers to an asset's ability to quickly convert into cash. Popular stocks are easy to buy or sell without major price loss. Liquidity is like water: the more of it in the market, the easier it is to "swim."

4. Spread

The spread is the difference between the price you can buy an asset for and the price you can sell it for. Imagine buying a concert ticket from a reseller: they bought it cheaper and sell it to you for more. The spread is their "salary."

5. Quote

Quotes are like a "price tag" for an asset in real time. They show how much an asset is worth now. Quotes indicate where the market stands and help you decide what to do next.

6. Leverage (Margin Trading)

Leverage is like a loan: you borrow money from your broker to increase your trading position. It can lead to higher profits but also greater losses. Use leverage cautiously, and remember: less is more.

7. Trend

A trend is the "mood" of the market. If the market is rising, it’s called "bullish" (people believe prices will increase). If the market is falling, it’s "bearish." Understanding trends helps you avoid going against the current.

8. Long and Short

When you buy an asset expecting it to rise, it’s called "going long." When you sell an asset expecting its price to drop, it’s called "going short." Don’t fear profiting from falling prices—just be aware of the risks.

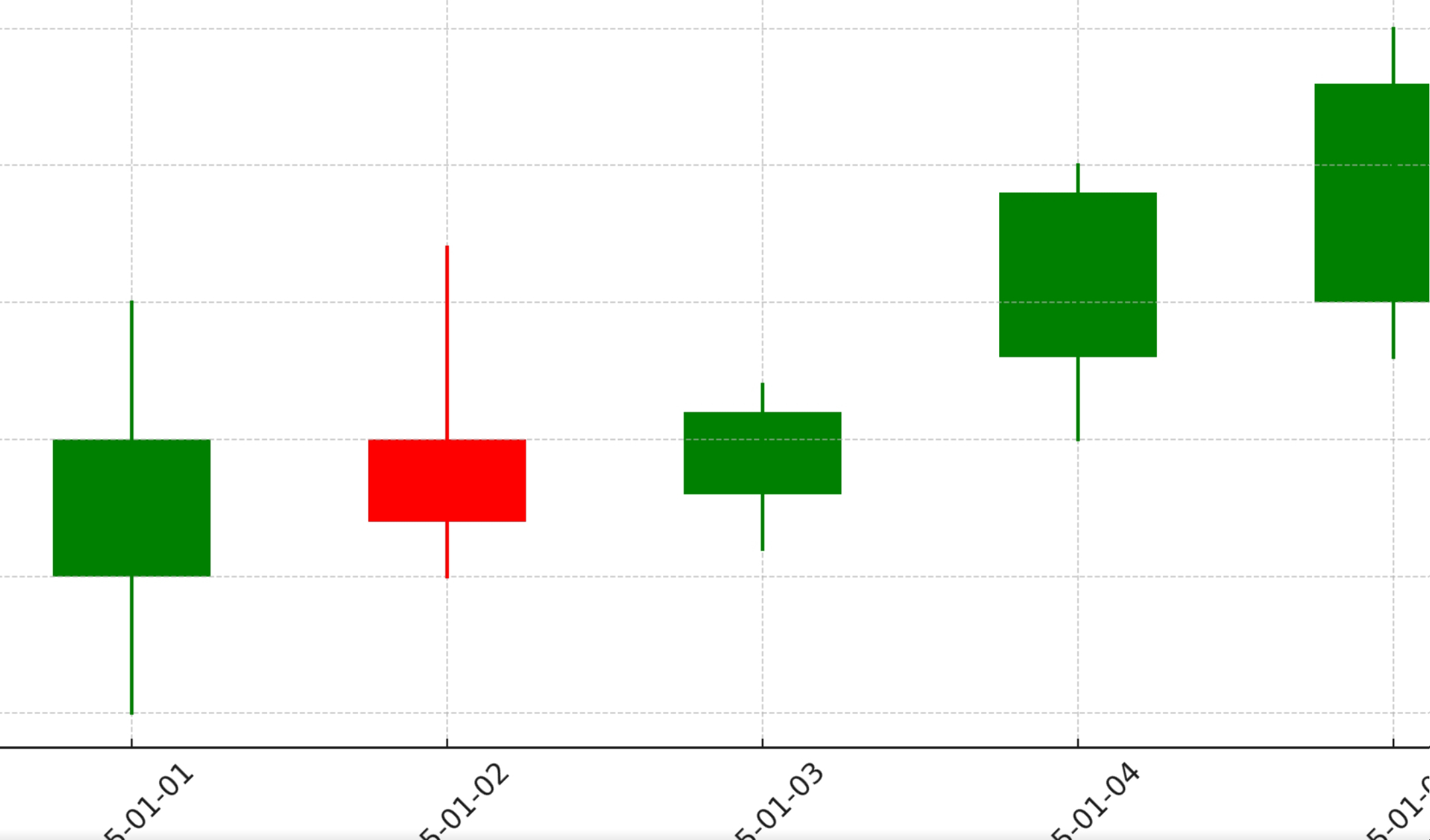

9. Candlestick Charts

Candlestick charts may seem complex, but they’re a visual way to understand price changes over time. Think of each candle as telling a story: where the price started, how high it went, and where it ended.

10. Take-Profit and Stop-Loss

These tools help you control your emotions. Take-profit closes a trade once you’ve reached your desired profit, while stop-loss prevents major losses. They’re like seat belts on the financial road.

11. Volatility

Volatility is the "emotion" of the market. When prices swing up and down rapidly, the market is volatile. It can be intimidating but also provides opportunities to profit. The key is to stay calm.

12. Diversification

Diversification is like "not putting all your eggs in one basket." By investing in different assets, you protect yourself from the risk of one failing. It’s the foundation of long-term stability.

Final Thoughts

The world of trading is a challenge. It can be exciting and requires patience. Understanding terms is the first step to grasping what’s happening in the markets. Don’t hesitate to ask questions, learn, and experiment. Remember, every successful trader has a story of ups and downs. The key is to start and keep moving forward.

Tips for Starting Trading Safely and Minimizing Risks

1. Learn Before You Trade with Real Money

Trading is not gambling; it’s an analytical activity. Before investing your money, dedicate time to learning. Read books, watch educational videos, and take courses. Practice on demo accounts to understand market mechanics without risking real funds.

Recommended books for beginners:

Trading for a Living by Alexander Elder

The Intelligent Investor by Benjamin Graham

Use demo accounts from reputable brokers to understand trading without financial pressure.

2. Control Risks and Use Discretionary Funds

Trading involves high risks. Never invest money intended for essential expenses like housing or education. Set loss limits and aim to risk only 1–2% of your capital per trade.

Always use stop-loss orders: they automatically close your trade if the market moves against you.

Keep a reserve fund to avoid financial difficulties.

3. Develop a Strategy and Stick to It

Random trading based on emotions leads to losses. Develop or choose a trading strategy and follow it. This includes:

Clear entry and exit rules.

A capital management plan.

Defined goals: how much you want to earn and what level of risk you’re willing to take.

Avoid the temptation to "chase the market" or immediately recover losses. Remember, trading is a marathon, not a sprint. Discipline and patience are more important than emotions.

Final Encouragement

Trading is a journey requiring time, learning, and patience. Don’t fear mistakes—they’re part of learning. Analyze your actions, learn from your and others’ missteps, and, most importantly, don’t rush. Gradual growth in knowledge and experience will lead to success. You’ve got this!

About BTCChange24

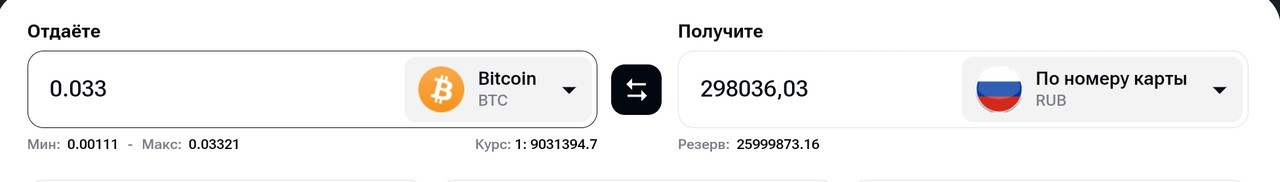

If you already own digital assets, BTCChange24 offers a quick and reliable exchange service for locking in profits, including various exchange pairs:

To explore all available exchange options, visit the main page of their website. Simply select the currencies you want to trade in the "Give" and "Receive" fields. See screenshot for guidance.